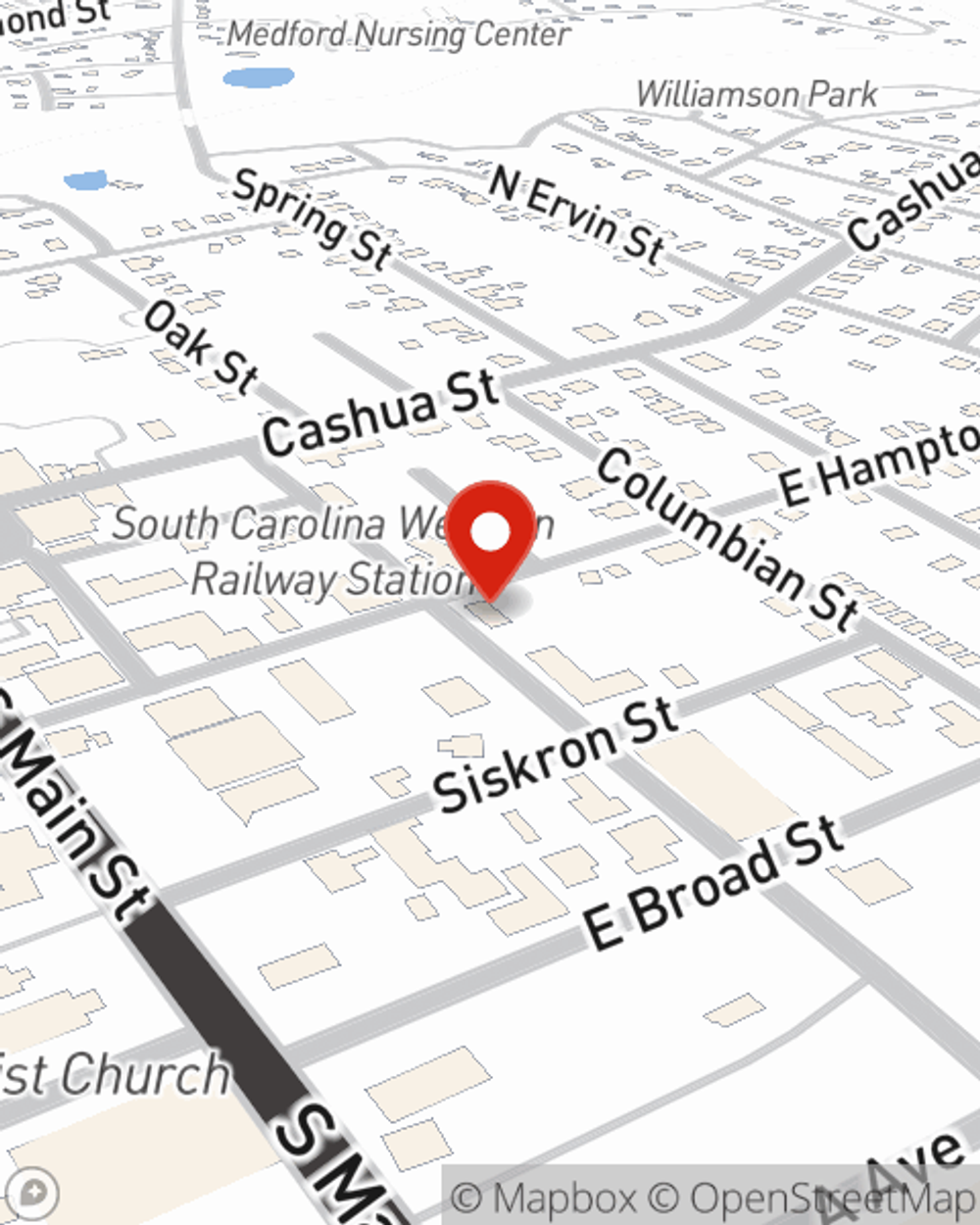

Life Insurance in and around Darlington

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Darlington

- Lamar

- Society Hill

- Hartsville

- Florence

It's Never Too Soon For Life Insurance

When it comes to high-quality life insurance, you have plenty of choices. Evaluating providers, riders, coverage options… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Bill Moore Jr is a person who can help you set you up with a plan for your specific situation. You’ll have a hassle-free experience to get cost-effective coverage for all your life insurance needs.

Insurance that helps life's moments move on

Life happens. Don't wait.

Life Insurance You Can Trust

When it comes to deciding on how much coverage you need, State Farm can help. Agent Bill Moore Jr can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, your health status, and sometimes even lifestyle. By being aware of these elements, your agent can help make sure that you get an appropriate policy for you and your loved ones based on your particular situation and needs.

Reach out to State Farm Agent Bill Moore Jr today to discover how the leading provider of life insurance can help you rest easy here in Darlington, SC.

Have More Questions About Life Insurance?

Call Bill at (843) 393-3752 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Bill Moore Jr

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®